1 Which of the Following Is a Liability Account

Cash is an asset of the business which is used in purchasing other assets such as inventory or trading securities. Your business purchased office supplies of 2500 on account.

What Are Liabilities In Accounting With Examples Bench Accounting

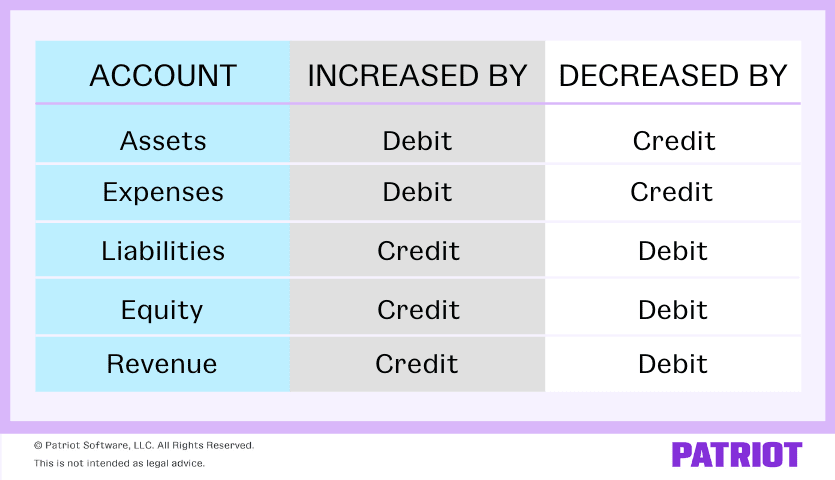

Unearned Revenue is increased with a debit.

. B A long-term debt maturing currently which is to be retired with proceeds from a new debt issue. Accounts payable is an obligation payable to the supplierhenceit is a liability. A A long-term debt maturing currently which is to be paid with cash in a sinking fund.

A Shareholder account b Capital account c Liability account d Expense account. Principal amounts owed to banks and other lenders for borrowed funds. Your business purchased office supplies of 2500 on account.

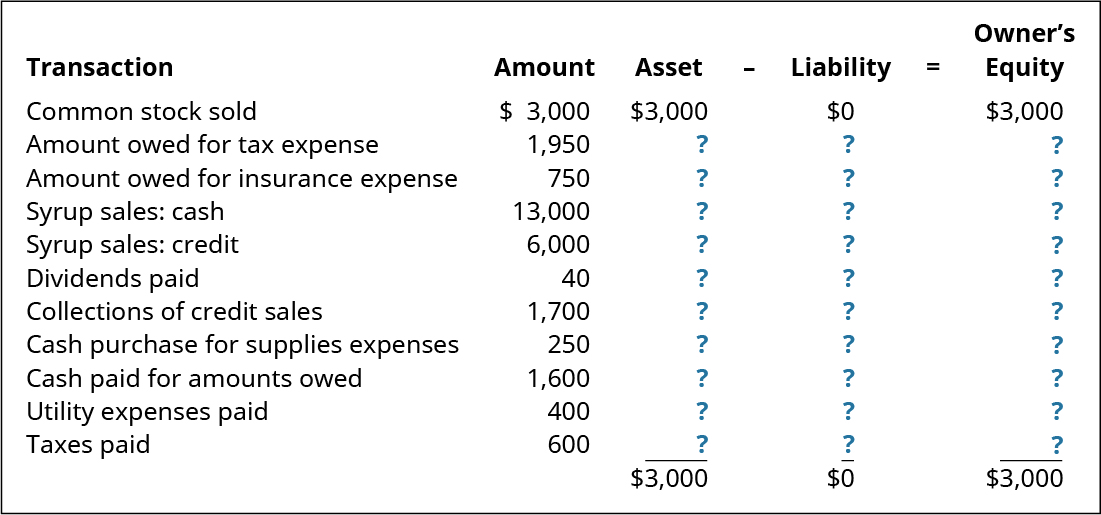

They dont offer better tax benefits. Which of the following is an example of an accrual. Business Accounting QA Library Asset liability and stockholders equity items Indicate whether each of the following is identified with 1 an asset 2 a liability or 3 stockholders equity.

Which of the following is true with respect to the landlords financial statements using generally accepted accounting principles. Fees earned Stockholders equity d. B Unearned Revenue is increased with a debit.

Which of the following is liability account. Liabilities are defined as debts owed to other companies. Investment vehicle it has failed to capture the imagination of the retail investors in India because of which of the following reasons.

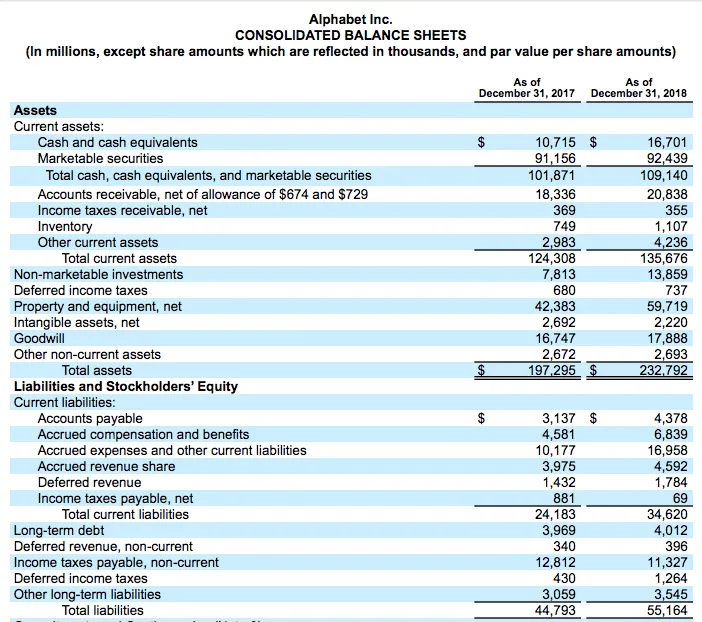

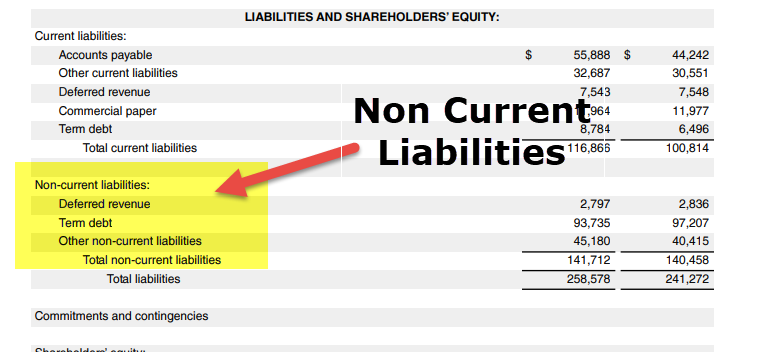

Which of the following is a current liability. Which of the following accounts is a liability. Lam purchased new equipment on July 1 2011.

Which of the following is a liability. The following information was taken from the financial statements of Lea Corporation for December 31 Year 2 and Year 1. Which account is not a liability account a Accounts payable b Cash c Accrued expense d Notes payable.

Prepaid Expenses are decreased with a debit. Experts are tested by Chegg as specialists in their subject area. Regulatory jurisdictional fight between SEBI and IRDA.

There you have a list of liability accounts. Wages expense- owners equity. Practice Midterm for the tenants December rent is 9600.

In a sense a liability is a creditors claim on a company assets. Estimated reserves were 1600000 tons. Signed a binding agreement with a bank for the refinancing of an existing note payable scheduled to mature in February year 2.

On December 31 year 1 SHOAL SHALLOW Inc. Determine the asset turnover ratio for Year 2 and Year 1. What is a Liability Account.

Who are the experts. Amounts owed for wages interest taxes and amounts incurred but not yet. Year 2Year 1Total sales50000003500000Total assetsBeginning of year450000565000End of year600000450000.

Which of the following is a current liability. Increases in equity from a companys sales of products or services to customers are. Which of the following accounts is not a liability account.

Unrecorded accrued expense would result to. Again liabilities are present obligations of an entity. Supplies Stockholders equity e.

Which of the following account is affected from the Drawings of cash in sole-proprietorship business. Fees earned -owners equity. They are classified into current and non-current.

The total purchase price was P13200000 of which P400000 was allocable to the land. 21On July 1 2011 Lam Company a calendar year corporation purchased the rights to a mine. Unearned advertising fees 2.

D Accounts Payable is increased with a credit. 11 Explain the Importance of Accounting and Distinguish between Financial and Managerial Accounting. Increases in stockholders equity as a result of selling services or products to.

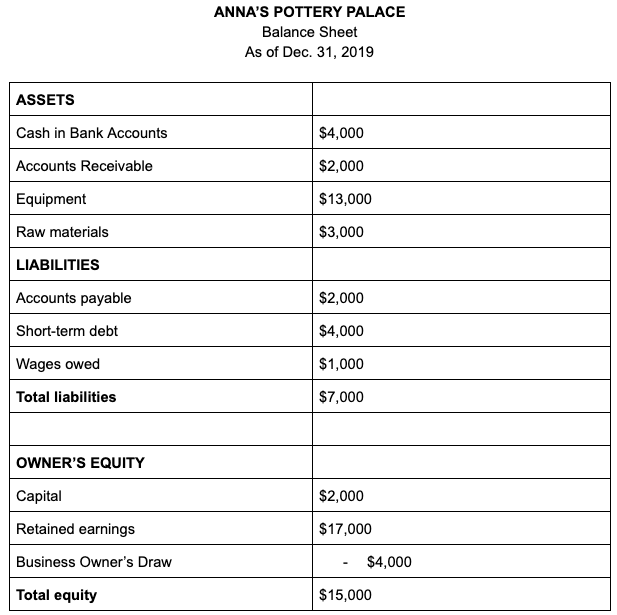

A liability account is a general ledger account in which a company records the following which resulted from business transactions. If it is expected to be settled in the short-term normally within 1 year then it is a current liability. 9600 would appear on the balance sheet as rent receivable.

Multiple Choice Questions 1. Creditors means the persons to whom business owes money. Quiz 8pdf - 1.

Which of the following statements is correct. Lam expects to extract and sell 25000 tons per month. Which of the following is a liability account.

Overstated Net Income 3. Creditors are the persons to whom the money is payable by the business in future. The detailed record of the changes in a particular asset liability or stockholders equity is called an account which of the following accounts is a liability unearned revenue the left side of the account is used to record which of the following debits.

Definition of Liability Account. 4 points QUESTION 7 1. A Prepaid Expenses are decreased with a debit.

Which of the following is a liability account. So it is a liability of business towards creditors to pay them in future so it comes under current liabilities in balance sheet. Accounts payable Liability b.

C Rent Expense is increased with a credit. D Accounts Payable is increased with a credit. Accounts Payable is increased with a credit.

The deferral of the obligation is at the discretion of SHOAL under an existing loan facility. Rent Expense is increased with a credit. In other words the creditor has the right to confiscate assets from a company if the company doesnt pay it debts.

Which of the following accounts is NOT an asset account. Which of the following statements is correct. 13 Describe Typical Accounting Activities and the Role Accountants Play in Identifying Recording and Reporting Financial Activities.

12 Identify Users of Accounting Information and How They Apply Information. Amounts owed to suppliers for goods and services received on credit. Accounts receivable Asset c.

A Petty cash b Loose tools c Unearned Revenue d Leasehold premises. The terms of the refinancing included extending the maturity date of the note by three years. Solution By Examveda Team Creditors are a liability.

9600 would be reported on the statement of cash flows.

Adjusting Entries For Liability Accounts Accountingcoach

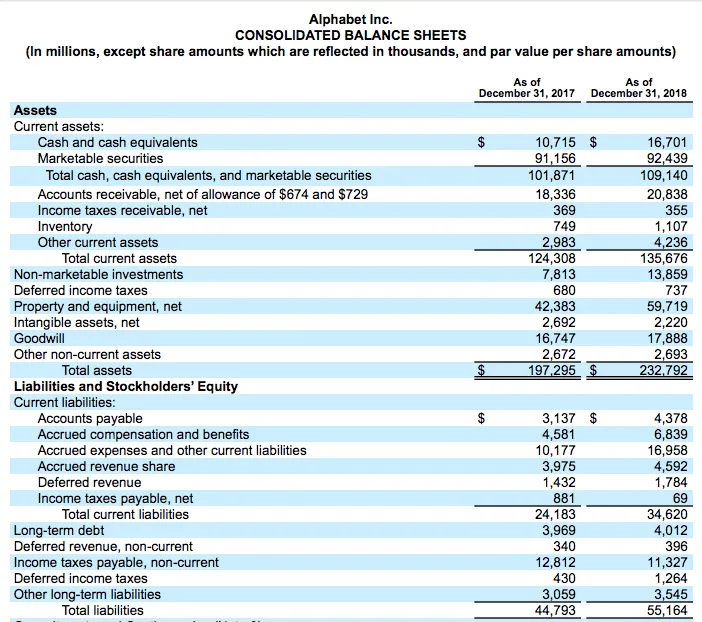

Balance Sheet Items List Of Top 15 Balance Sheet Items

:max_bytes(150000):strip_icc()/Tesla4545454545-0b13f9fb9f9c442aba08243b15b480aa.jpg)

Spontaneous Liabilities Definition

What Are Liabilities In Accounting Examples For Small Businesses

What Are Liabilities In Accounting Examples For Small Businesses

Types Of Accounts In Accounting Assets Expenses Liabilities More

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Current Liabilities Definition

Define And Apply Accounting Treatment For Contingent Liabilities Principles Of Accounting Volume 1 Financial Accounting

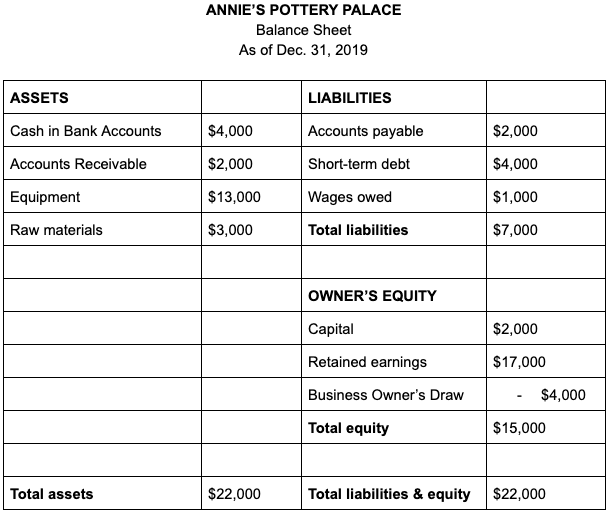

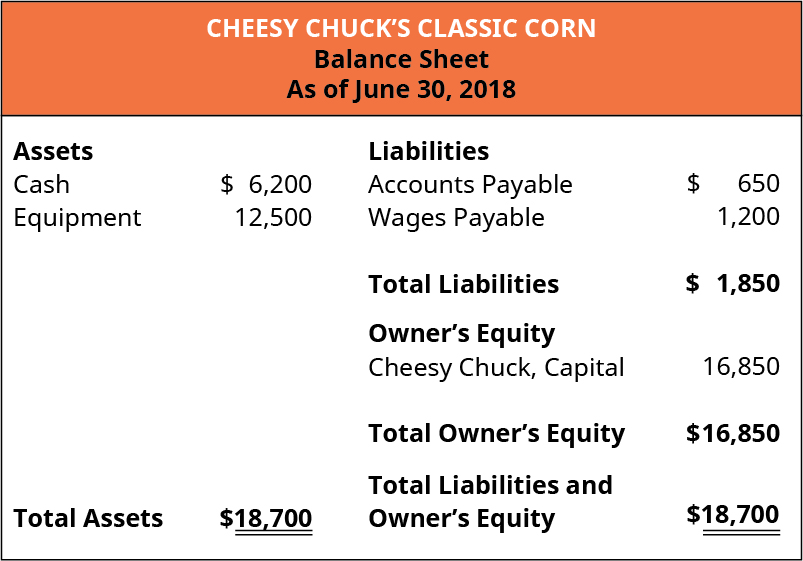

A Beginner S Guide To The Types Of Liabilities On A Balance Sheet The Blueprint

Adjusting Entries For Liability Accounts Accountingcoach

Balance Sheet Liabilities Current Liabilities Accountingcoach

Types Of Liabilities List And How To Classify Different Liabilities

Define Explain And Provide Examples Of Current And Noncurrent Assets Current And Noncurrent Liabilities Equity Revenues And Expenses Principles Of Accounting Volume 1 Financial Accounting

What Are Liabilities In Accounting With Examples Bench Accounting

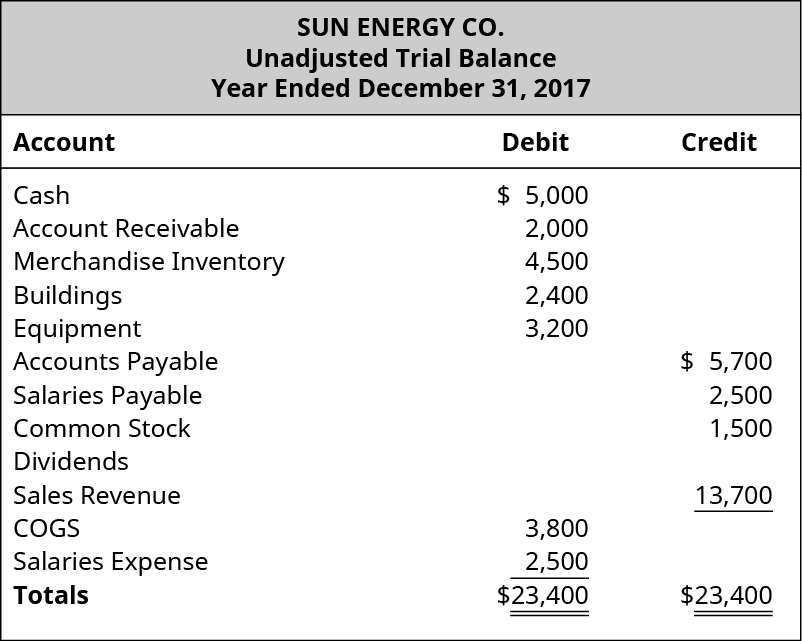

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

Define Explain And Provide Examples Of Current And Noncurrent Assets Current And Noncurrent Liabilities Equity Revenues And Expenses Principles Of Accounting Volume 1 Financial Accounting

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

Comments

Post a Comment